Vehicle Damage Calculation Systems and incadea.dms

To set the premise, software solutions that help insurers organize and manage the claims process from first notice of loss (FNOL) to settlement are insurance systems.

Breaking it down further, insurance systems are dedicated to efficiently handling claim settlements, policy administration, reinsurance, accounting, loss control, and damage calculations.

In the automotive industry, there are various aspects to consider, for instance, handling collision repair processes, including estimating damage and creating a repair plan. In damage calculations, each requested repair can have various operations to be selected and each replaced part can easily have countless types of alternatives from different OEMs.

The main concerns are:

How does one ensure that the right operation has been selected?

How can one know that all of the damaged parts were included in the estimate?

Or if any extra parts were added to damage calculations by mistake?

Without a doubt finding the correct answers for such questions used to be a rigorous job for insurers. It is at this point, where the Damage Calculation systems could be devised and spread among insurers to produce a safe repair estimate which complies with their standards.

Audatex or Silver DAT II are two examples of Damage Calculation Systems well-used among insurers and car dealers. Such applications enable repair facilities to provide accurate estimating of costly repairs and processioning insurance claims comfortable.

On top of that, if both the DMS and the Damage Calculation System are connected, then submitting service repairs from DMS and receiving accurate estimates from Damage Calculation Systems makes the claim process uncomplicated and streamlined for all parties involved.

-

-

- for dealers to better organize their repair orders,

- for insurers to better control the claim process according to their standards

- and finally for customers to get their vehicles back on the road faster.

-

This win-win situation could boost customer experience to the next level!

If you want to know more about that, please follow my article where I am explaining data flow between both incadea.dms and Damage Calculation Systems.

To better illustrate how incadea.dms and damage calculation systems cooperate, one should understand the basic workflow between both applications.

In cases where insurers supervise their estimators usually, the process starts in the damage calculation system. On the other hand, many car dealers have already "won" the trust of insurers, and repair estimates are performed in their direction. Let's look at each one in turn.

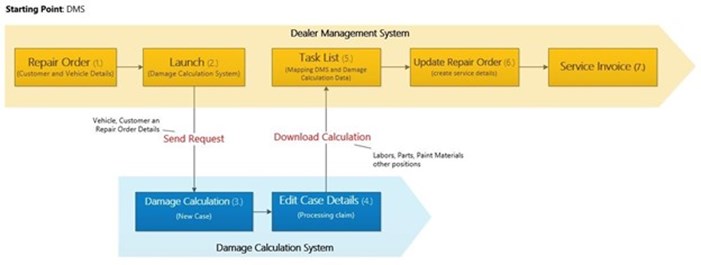

Workflow from the incadea.dms side.

A service advisor creates a new service order with details of customer, vehicle, and service order (1.). Incadea.dms Service Order is "connected" via the damage calculation system (2.). This step enables the creation of the repair estimate (3./4.), which complies with insurers' standards.

"Harmony" between incadea.dms and damage calculation system can be easily broken with problems related to data diversity. For example: by different formats of part numbers (677711 and A677711).

To "bridge" similar situations, our incadea.dms have a clever way to "translate" and convert data into the database (5.).

Labour, parts, painting material, and other items, including sales price, are loaded to the original repair order for further processing (6.).

A final service invoice prepared according to an already approved repair estimate will significantly speed up the settlement of the invoice with insurers (7.).

Now see the scenario from the opposite angle.

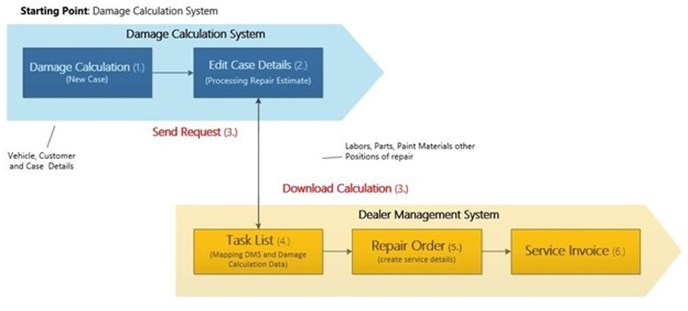

Workflow from the Damage Calculation Systems

Workflow from the damage calculation systems insurers uses to ask their own or external technicians to prepare repair estimates that comply with their standards. In such cases, creating a repair estimate starts after visual vehicle inspection and mostly without direct dealer assistance out of the DMS.

A new case with the vehicle, customer, and finding details is being created in the damage calculation system (1.).

A repair estimate is edited, processed, and later provided by insurers to dealers for realization as a part of the newly created service order in incadea.dms (2.).

Service Advisors can load a repair estimate into our incadea.dms either as a file or using the "Call Damage Calculation System" function as part of an interface solution (3.).

Finally, the repair estimate is converted into the service order (4.) with all details related to labor positions, parts, etc., including approved sales price information. Now service advisors are ready to check and proceed with a service order (5.) according to an approved repair estimate directly in the incadea.dms (6.).

For a car dealer to have on hand, such an interface between damage calculation systems and DMS offers a significant "accelerant" of the whole apparatus of claim settlements on collision repairs. We are pleased that we can offer such an "accelerant" for our customers.

I hope you were able to gain some insight from the article. Looking forward to your feedback and am genuinely interested in your opinion of it.

Dr. Juraj Hanus

Product Management DMS | juraj.hanus@incadea.com