SUVs - The Next Big Segment

The automobile industry has been growing as a whole for consecutive decades now. However, there is one particular consumer segment, which is beginning to take off and overtake the previous market leader. Sport Utility Vehicles and Crossovers are picking up steam globally, and not simply limited to the growth markets such as China, Brazil and India.

It seems that the automotive industry is following a similar path as that of the cellphone industry, which initially had cellphones getting smaller, before increasing in size.

Immense growth - not limited by terrain or region

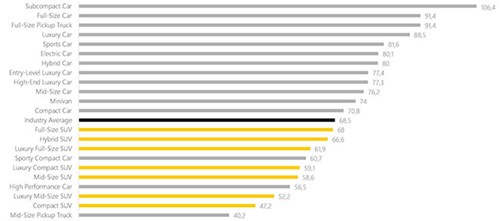

The growth is also not limited to specific terrain conditions, although countries with off-road/dessert terrains have certainly blossomed in terms of larger personal vehicles, such as South Africa, in which one in every three vehicles sold is an SUV or a Pickup Truck. China for example, is experiencing a year on year SUV sales growth of 46% despite the majority of the populations flooding to megacities where such a large vehicle is not a necessity. In the European Union even, a region which has taken the lead for compact, mini and electric vehicles, has seen the SUV segment balloon to a market share of 22.5% of all vehicles sold (ACEA, 2016). Finally, in the United States, SUV and Crossovers have been flying off the shelves at dealerships, a sure sign that customer demands and needs are shifting. In fact, the average SUV is only in stock for 59.1 days, compared to subcompact cars (106.4 days), electric cars (80.1 days) and compact cars (70.8 days).

Figure 1: Average Days on Stock for Vehicle Segments in the United States (Kelly Blue Book, 2016)

So the question is, why is the growth occurring now?

The developments in the last 5-10 years indicated that the trend would certainly be shifting towards urban, compact, fuel-efficient or even electric vehicles dominating the market. The first variable that presents itself is the recent downturn of oil prices. The crude oil price was floating around the $100 mark per barrel for most of the last 5 years until it plummeted to $30 in late 2015, before stabilizing at the high $40 mark as of today. This deduction presented an opportunity for customers, as the fuel-inefficient SUVs were theoretically granted a discount.

SUVs are becoming price competitive

Although the decreases in fuel prices affected SUV sales, the more impactful reason lies in the fact that automobile producers have expanded the range of products offered within this specific automotive segment. Just like the sedan segment, SUVs are now separated into luxury and non-luxury classifications and come in compact, mid-sized, full-sized and hybrid differentiations. In order to clarify the differences in size, let us use BMW as an example, in which the X3 is classified as compact, X5 as mid-sized and X6 as full-sized. Due to the diversification, SUVs are not solely seen as off-road vehicles but adaptable to urban or suburban lifestyles. The production of hybrid vehicles and eventually electric ones (such as the Tesla Model X) ensures that the SUV trend will continue to grow and target green consumers in the future.

With diversification comes competition, which further pushes the prices of SUVs to fall dramatically. In the past, vehicles of this size required a hefty investment from consumers, easily around $50,000 or beyond. Compare that to the newest Great Wall X200, which boasts a competitive value of $25,000. The increase in competition does not solely stem from growing markets such as China or India. In fact, competition amongst the luxury SUV segment is gaining just as much traction with Daimler recently joining BMW, Audi and Porsche as high-end manufacturers. Additionally, Maserati, Lamborghini, and Bentley are all expected to release their sport SUVs in the coming year or years in order to capture the growing demand amongst high-end consumers.

Another contributor for the decrease in price, other than the fierce competition, is the change in manufacturing and technology. In the past, the vast majority of SUVs were built with four-wheel drive capabilities (4x4), in order to maintain the image that this segment is specifically designed for off-road and harsh terrain or weather conditions. With the increase in demand, automotive OEMs have adapted themselves by manufacturing SUVs which have two-wheel drive capabilities. With this development, manufacturers are able to mass-produce these larger vehicles, in a similar fashion as regular cars to reduce costs significantly.

The bigger, the better, the safer?

Finally, there is a growing sense amongst consumers, particularly female and family consumers, that the SUV is the ideal vehicle due to its perceived safety. When consumers decide which vehicle to buy, safety as a purchasing factor has fallen to rank 10 over the years (J.D. Power, 2013). This decrease in ranking has not stopped the flow of consumers flocking towards SUVs. Despite the fact that SUVs have not been scientifically proven to be safer than their sedan counterparts, drivers often subconsciously believe they are, due to the increased size, weight and ride height or height of chassis, which allows drivers to see over lower riding sedans and notice potential threats earlier.

Diversification is key for the future

Despite the shift towards electric and urban-oriented automobiles, SUVs have gained a significant market share across the globe and continue to show strong signs of growth. It remains to be seen if this is sustainable in the long-term. However, as long as OEMs and manufactures are capable of continuously diversifying and eventually offering fuel-efficient or even electric SUVs, the market is ripe with customers with a changing need and demand.